Introduction

India’s digital payment ecosystem is on the brink of a major shift as the long‑standing requirement of entering a UPI PIN is set to disappear. Leading the change, Amazon Pay has rolled out a biometric authentication feature that lets users approve transactions with a fingerprint or facial scan. The move promises faster checkout, reduced friction, and a new layer of security for the country’s 750 million‑plus internet users. This article examines how the technology works, why Amazon Pay is first to market, the security considerations, the impact on merchants and consumers, and what the future may hold for a PIN‑free India.

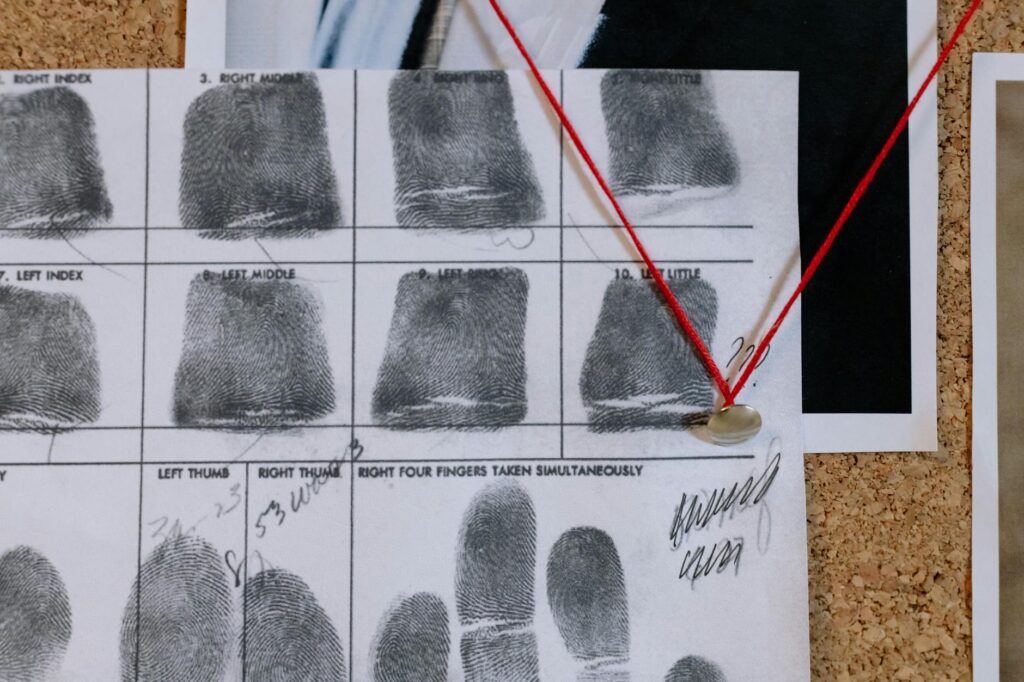

Biometric UPI: how it works

Biometric UPI integrates the existing Unified Payments Interface (UPI) framework with device‑level authentication. When a user initiates a payment, the app triggers the phone’s secure enclave to capture a fingerprint or facial image. The biometric data never leaves the device; instead, a cryptographic hash is generated and sent to the UPI server for verification. If the hash matches the stored template, the transaction is approved without a PIN. This approach leverages the NPCI‑approved Biometric UPI API, which was standardized in early 2024.

Amazon Pay leads the rollout

Amazon Pay was the first payment app to embed the Biometric UPI API into its Android and iOS clients. The launch, announced in October 2025, is available to all users with a linked bank account and a device that supports either fingerprint or facial recognition. Early adopters report a 30 % reduction in checkout time compared with traditional PIN entry. Amazon’s decision to go live ahead of rivals such as PhonePe and Google Pay underscores its strategy to capture a larger share of the high‑velocity payment market.

Security and privacy implications

Biometric authentication is often touted as more secure than a four‑digit PIN, but it raises new concerns. The data remains encrypted on the device, and the hash cannot be reverse‑engineered into the original biometric image. Nonetheless, experts warn about potential spoofing attacks and the need for robust liveness detection. Regulators have mandated that all biometric UPI transactions be logged with a timestamp and a device‑ID, enabling forensic audits if fraud is suspected.

Impact on merchants and consumers

For merchants, the shift means faster order processing and lower cart‑abandonment rates. A recent survey by the Confederation of Indian Industry (CII) shows that 42 % of small retailers anticipate a 15‑20 % increase in conversion after adopting biometric checkout. Consumers benefit from a frictionless experience, especially in high‑traffic environments like metro stations and grocery stores where entering a PIN can cause bottlenecks.

| Year | % of UPI transactions using biometrics | Biometric UPI users (million) |

|---|---|---|

| 2023 | 3.2 % | 12 |

| 2024 | 7.8 % | 28 |

| 2025 | 14.5 % | 53 |

Future outlook for cashless India

The biometric UPI rollout aligns with the government’s vision of a cash‑less economy by 2026. As device penetration deepens and AI‑driven liveness checks improve, the reliance on PINs is likely to vanish completely. Industry analysts predict that by 2027 more than half of all UPI transactions will be authorized via biometrics, paving the way for further innovations such as voice‑based payments and wearable‑linked authentication.

Conclusion

Amazon Pay’s introduction of fingerprint and facial authentication marks a watershed moment for India’s digital payments landscape. By eliminating the UPI PIN, the new feature streamlines checkout, enhances security, and offers tangible benefits to both merchants and consumers. While privacy and spoof‑proofing remain critical challenges, the rapid adoption rates reflected in the latest statistics suggest a strong appetite for biometric solutions. As the ecosystem matures, biometric UPI is set to become the new norm, accelerating India’s journey toward a fully cashless future.

Image by: cottonbro studio

https://www.pexels.com/@cottonbro